PPF Calculator

PPF Results

PPF Maturity Amount:

Total Investment:

Total Interest Earned:

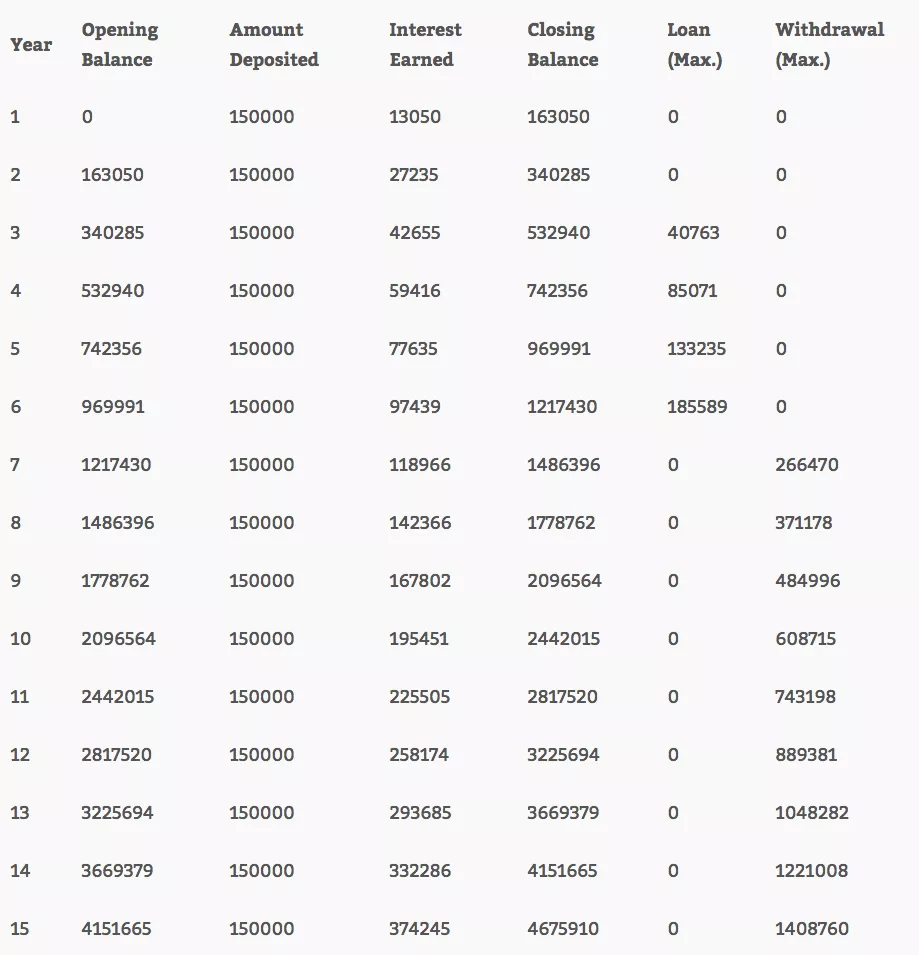

| Year | Maturity Value | Total Investment | Total Interest Earned |

|---|

PPF Calculator will help you to calculate interest on your investment you make into your PPF account. This tool will let you know the amount you will make over a period of 15 years with the investment you make into your PPF account every year. It will calculate the interest for every year and will compound it for the next year up till a period of 15 years. You need to enter few fields and the result will be shown in the tabular form as well as graphical representation that will be quiet easy for you to understand.

If you feel that the calculation on this page are not as expected, please visit the full-featured ppf calculator.

Some PPF Rules you need to know

- From 1.4.2014, PPF interest rates is 8.70% per annum (compounded yearly).

- Minimum Rs. 500 Maximum Rs 1,50,000 in a financial year.

- Lock-in period is of 15 years (some withdrawals can be made from the sixth year)

- Interest is tax free !

- Loan facility available from 3rd Financial Year

- The PPF account can be opened in a Post Office which is Double handed and above or in Nationalised banks ( like (SBI, PNB, Central Bank of India etc) or some authorized private banks (ICICI, HDFC, Axis Bank etc)

- Joint account cannot be opened.

- Deposits qualify for deduction from income under Sec. 80C of IT Act.

Public Provident Fund (PPF) is a long term investment plan by government of India with attractive interest rates that are fully backed by government. You can start a PPF account with a minimum of Rs 500 and a maximum of Rs 1,50,000 for a locking period of 15 years.

Lets show you how much you can make from a PPF account if you invest 1,50,000 for the period of 15 years.

Maturity amount will be = Rs 4675910 (46.8 Lakhs)

FAQs

What is the interest rate on PPF?

Ans: From 1.4.2014, PPF interest rates is 8.70% per annum (compounded yearly).

Is PPF tax free?

Ans: Yes the amount is totally tax free and even the interest earned form the amount

What are the benefits of PPF account?

Ans: Tax benefit under Section 80 ‘C’ available.Maximum limit: Rs 1,50,000, Good long-term investment option, Interest Paid: 8.70%, compounded annually, Interest is fully Exempt from tax

What is the locking time period of PPF account?

Ans: 15 years

What is the lower and higher limit of amount to be deposited in PPF account PA?

Ans: Minimum Rs. 500 Maximum Rs 1,50,000 in a financial year.

Where can I open PPF account?

Ans: The PPF account can be opened in a Post Office which is Double handed and above or in Nationalised banks ( like (SBI, PNB, Central Bank of India etc) or some authorized private banks (ICICI, HDFC, Axis Bank etc)

Searched Keywords : ppf, ppf account, ppf calculator, ppf interest rate, ppf rules

What is Public Provident Fund (PPF) Calculator?

An online PPF calculator helps the investor to come to a number of returns that can be acquired and the savings growth or maturity amount per investment through the years according to the contribution amount, nominal rate of interest, and investment duration. This helps investor to have a golden insight on investment in PPF. It can be for anyone who wishes to invest in PPF but is unaware of the amount required to be invested or the returns invited.

Why Use a PPF Calculator?

Using a PPF calculator offers several benefits:

- You Can Visualise Your PPF Growth:it lets you know how your PPF would look like after growing over the years, and this is quite helpful in planning how deep your pockets should in order to achieve your financial targets such as retirement, children’s school or marriage expenses.

- Compare investment options:Remember that the rate of return on the PPF represents the ‘opportunity cost of foregoing consumption’. It quantifies the benefit that would come from using the same amount of resources in alternative investment options such as bank deposits. For instance, if you’re deciding whether or not to contribute to a National Pension Scheme or withdraw from the PPF and buy gold coins, then the interest on the PPF becomes relevant.

- Maximise Contributions: Maximum Contributions: Helps you make the most of your Rs1.5 lakh p.a. limit before you miss out on the opportunity to put in more.

- Log Progress: Allows you to track your PPF in a way that helps you feel motivated to stay on track with accomplishing the financial goals that you’ve set for yourself.

How to Use a PPF Calculator

Using a PPF calculator is pretty easy. Here’s what you need to do:

- Enter the financial year you wish to receive the PPF for – in this case, it would be all financial years that will be applicable in the future.

- Enter the amount of money you wish to invest.

- Indicate whether you want to pay through cheque or digital mode.

- Choose how you would simply want to invest this amount each year; in this case, your investments will be simple.

- Click on ‘Calculate’. The online PPF calculators will provide you with set timelines for your payment: half-yearly, quarterly, monthly, or yearly.

- Decide the Frequency of Investment: Decide whether you wish to avail options on the given day of each month, the 1st day of every calendar quarter, the first day of every calendar half year, or the first day of the each calendar year. In case you are a salaried individual, monthly works well for convenience and precision.

- Enter amount into Monthly PPF Investment: Here, enter the amount you want to deposit in the given PPF account. Don’t exceed Rs 12,500 in a month or Rs 1.5 lakh in a year.

- Pick the Period of Investment: pick the amount of time you would like to invest. The minimum time horizon is 15 years. Here you can extend every five years.

- Future Value: Enter the maturity amount here automatically when you fill in all of your details.

How the PPF Calculator Can Help You

PPF calculator is an easy tool to track your account balance and its growth. It helps to address questions related to changing interest rates and how the maturity value is affected by the fluctuating interest rate regime around it. Any PPF account opening form would require basic information like the sum of initial deposit, tenure and investment frequency. In contrary to this, the PPF Calculator helps you visualise definite profit and ground the PPF calculations in your system.

Formula Used for Calculating PPF

A PPF calculator uses a formula similar to that for calculating the future value of an annuity. The formula is:

M = P [ ( (1 + i) ^ n - 1 ) / i ]

Where:

M = Maturity benefit

P = Annual installments

i = Interest rate

n = Number of years

This formula helps calculate the maturity value of your PPF investment.

Example Calculation

For instance, if you deposit Rs 1,00,000 annually for 15 years at the rate of interest of 7.1 per cent, your maturity value will be:

M = Rs 1,00,000 [ ( (1 + 0.071) ^ 15 - 1 ) / 0.071 ] = Rs 27,12,139

Advantages of Using a PPF Calculator

Some of the key advantages include:

- Accuracy: Calculates maturity amounts precisely from an input consisting of an investment amount and its frequency.

- Time-saving: Delivers results quickly, saving the need for manual calculations.

- Financial Planning: Assists in setting realistic financial goals by projecting potential returns.

- Flexibility: Allows experimenting with different scenarios by adjusting parameters.

- Convenience: Easily accessible online, making it convenient to calculate PPF investments anytime.

Frequently Asked Questions

How is the interest calculated on PPF investment?

The interest on the PPF account is declared by the government. It would be applicable to your PPF account from the beginning of the quarter with reference to the balance in your PPF account as on the preceding five days before the beginning of the quarter. Park your deposits before the end of the five-day period.

What is the minimum lock-in period for PPF?

Contract a minimum of 15 years, renewable at intervals of five years, you can request to withdraw funds only five years from the day you start investing, withdraw completely or partially.

What is the minimum amount required to invest in PPF?

You can start investing in PPF with as little as ₹500.

How much can i get returns in PPF after 15 years?

The maturity amount is also the amount invested plus the interest that has compounded over 15 years: the yield on the investment multiplied by the principal.

Is PPF investment tax-free?

Yes – whether it’s interest earned or the maturity amount, investments of ₹1.5 lakh each year qualify for income tax exemption. Contributions to such accounts are eligible for tax deductions.

How is the PPF maturity period calculated?

The maturity sum is also the investment sum compounded over 15 years of yearly yield: the yield on the investment multiplied by the principal.